West Bengal Student Credit Card Scheme Apply | West Bengal Student Credit Card Application Form | WB Student Credit Card Scheme Eligibility | WB Student Credit Card Scheme Benefits

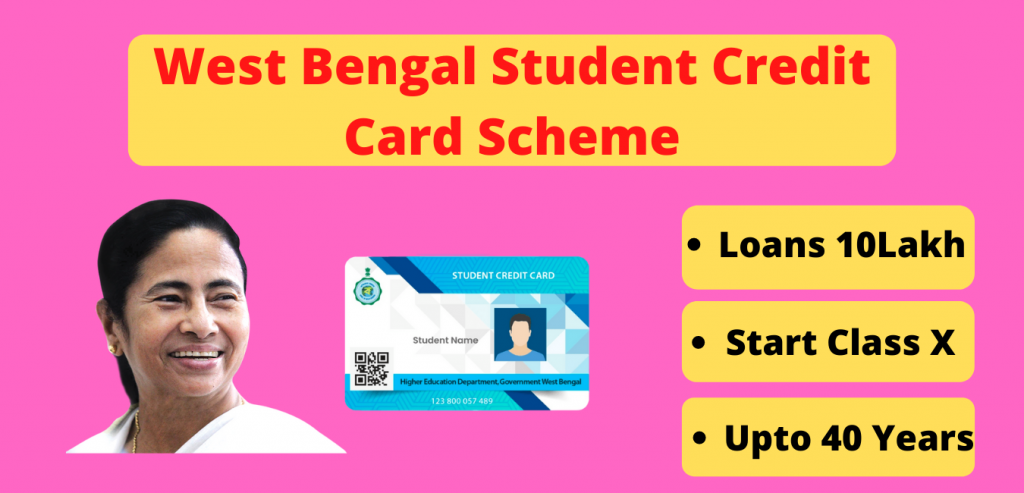

West Bengal Student Credit Card Scheme: CHIEF MINISTER Mamata Banerjee on Wednesday launched the WB Student Credit Card Scheme, which was announced by her before the Assembly polls. Mamata Banerjee said, “To further encourage students from West Bengal to pursue higher studies, the state government has decided to launch one of the most comprehensive and inclusive schemes in the country: ‘WB Student Credit Card’ to enable them to avail collateral security free loan of up to Rs 10 lakh at a nominal, annual simple interest rate with a repayment period of 15 years.”

Under the scheme, a student of Class X or higher can avail of a soft loan of up to Rs 10 lakh to pursue higher studies in schools, colleges, institutes in Bengal, other states, or abroad. Any applicant can avail themselves of the facility till the age of 40 years. The loan would have to be repaid in 15 years.

Read More: West Bengal Kanyashree Prakalpa 2021

WB Student Credit Card Scheme Details

What is West Bengal Student Credit Card Scheme?

West Bengal has introduced the WB Student Credit Card Scheme for the students of West Bengal, to enable them to pursue education without having any financial constraints. This scheme is designed to support the students to pursue secondary, higher secondary, madrasah, undergraduate, and post-graduate studies including professional degree and other equivalent courses in any School, Madrasah, College, University, and other affiliated institutes within and outside India.

Students studying in various coaching institutions for appearing in different competitive examinations like Engineering, Medical, Law, IAS, IPS, WBCS, etc, can also avail of the loan under this WB student Credit Card scheme.

Read More: Link Adhaar to Ration Card

WB Student Credit Card Scheme- Overview:

| Event | Information |

| Name Of The Scheme | West Bengal Student Credit Card Scheme |

| Launched By | West Bengal Government |

| Beneficiary | Student Of West Bengal |

| Objective | To Provide Loans For Higher Education |

| Official Website | Click Here |

| Amount Of Loan | Up to Rs 10 Lakh |

| Repayment Period | 15 Years After Getting Job |

| Application Type | Online/Offline |

Repayment of WB student Credit card Scheme

(a) Repayment period shall be fifteen (15) years for any loan availed under this Credit Card including the Moratorium/ repayment holiday.

(b) The student or his parent/ legal guardian can repay the loan amount at any time before the stipulated period of repayment and in case of early repayment, there shall be no penalty or processing cost charged by the Bank.

(c) 1% interest concession will be provided to the borrower if the interest is fully serviced during the study

period.

(d) The student or the co-borrower, as the case may be, shall be liable to repay the loan on time as 1st charge.

(e) The loan will be made available at the rate of 4% p.a. simple interest rate per annum to the students. Appropriate subvention of interest rate will be provided by the State Government for all the borrowers during the entire period of the Loan to restrict the actual rate of simple interest to 4% per annum, at borrower level.

Objective Of West Bengal Student Credit Card Scheme

The main objective of the WB Student Credit Card is to further encourage the students to pursue higher studies and to facilitate them with necessary funds for pursuing same, the State Government proposes to support the students by providing a Credit Card, having a maximum limit of Rs. 10 lakhs available at a nominal rate of 4% simple interest rate per annum so that the students can avail necessary funds as and when needed for their studies.

Benefits And Features Of West Bengal Student Credit Card

Under this student credit card scheme the Credit Card may be used to avail loan to meet up the following expenses: –

(a) Course fees payable to the School/ Madrasah/ College/ University / Professional Institutes like IITs, IIMs, IIESTs, ISIs, NLUs, AIIMSs, NITs, XLRI, IISCs, BITS, SPA, NID, IIFTs, ICFAI Business School, etc. various competitive coaching institutes meant for different competitive examinations like Engineering/Medical/Law, IAS, IPS, WBCS, SSC, etc.

(b) Fees required for accommodation in School/ Madrasah/ College/ University/ Institution hostel or rent/ license fees payable for living outside the hostel or fees required for living as a Paying Guest.

(c) Fees payable for caution deposit/ building fund / refundable deposit/ examination/ library/ laboratory fees to be supported by Institution’s bills/ receipts.

(d) Cost of purchasing of books/ Computer/ Lap-top/ Tablet/ equipments etc.

(e) Any other expense required to complete the course such as study tours, project works, thesis, etc.

(f) The student can incur expenditure up to 30% of the total loan sanctioned for non-institutional expenses for the whole course of study.

(g) Up to 20% of the total loan sanctioned can be used as living expenses for the duration of the course

Eligibility Criteria Of West Bengal Student Credit Card

(a)The applicant must be a permanent resident of West Bengal

(b)Applicant must be living in West Bengal for a period of at least 10 years

(c)The upper age limit to apply for this scheme is 40 years

Required Documents To Apply For WB Student Credit Card Scheme

- Aadhar card

- Residence certificate

- Age proof

- Ration card

- Income certificate

- Bank account details

- Mobile number

- Passport size photograph

How To Apply For WB Student Credit Card Scheme

If you want to apply for the WB student credit card scheme then you have to follow the steps given below:-

- First of all, go to the official website.

- You will see the Student Registration Button, Click this button.

- After that, you have to fill in all the required details in this form like your name, Date of Birth, mobile number, Aadhaar Number ,email id, etc and Click next button.

- Here, you will see Applicant Registration section, fill all the details and click the Submit button.

- After completion of the registration process a unique id will be generated which will be sent to your mobile number which will be used as your user id for submission of application. This unique id will be used as user id for all future purposes.

- Now, go to the home page and login in your account.

- You will see a applicant dashboard. Now fill permanent address and course, income details

- Now, go to the home page and login in your account.

- You will see a applicant dashboard. Now fill permanent address, course, income details & bank details.

- Now, upload all the required documents and click final submission.

- Once form is submitted properly by the student, it shows that the form is submitted to the Institution. But In case of pending of submission, the application will be returned by the Institution to the applicant. So be careful.

- By following this procedure you can apply for the West Bengal student credit card scheme.

Contact Details:

HelpLine No. 18001028014

Email Helpline: -wbscc@bangla.gov.in

or

contactwbscc@gmail.com

Frequently Ask Question:

Student Credit Card Scheme FAQ Question:

Ans. Maximum amount of loan eligible under the scheme is Rs. 10(ten) lakhs.

Ans. No, there is no need for obtaining any NOC from the institution.

Ans. Minimum eligibility to apply for the loan under the scheme is Class IX passed from any of the recognized Boards which are active in West Bengal.

The applying student is also to be enrolled in Class X or for 10+2 or higher education in any course in any recognised Higher Education Institution or in

a coaching institute.

Ans. Yes, a student can apply for loan under SCC scheme anytime during the course.

Ans. No, there are no marks percentage criteria for applying in the scheme.

Ans. You will receive SMS in your registered mobile number.

Ans. No. There is no income ceiling for candidates to apply in the SCC scheme.

Ans. Student has to contact the State Help Desk.

Ans. Yes, you can apply if your family is residing in West Bengal for a period of 10(ten) years at the time of application under the SCC scheme, your institution is recognized and you are otherwise eligible as per the scheme.

Ans. The State Co-operative Banks or Central Co-operative Banks or District Central Co-operative Banks or any other Public and Private sector Banks shall be authorized to issue the credit card and sanction loans under SCC scheme.